Table of Content

Personal Internet Banking services are available 365 days a year and 24 hours a day, except during system maintenance and upgrades. When this occurs, a message will be displayed online when you sign on to Personal Internet Banking. You do not report a lost or stolen Password or PIN within two business days (you may be responsible for up to $500 from date of loss to date of reporting loss).

Questions about how the coronavirus is affecting your finances or our services? You also understand and agree that we are not responsible for any losses or damages if circumstances beyond our control prevent us from making a Bank to Bank Transfer or if the HSBC website was not working properly and you knew about the breakdown when you started the Bank to Bank Transfer. As a condition of using the Service, you warrant to us that you will not use the Service for any purpose that is unlawful or is not permitted, expressly or implicitly, by the terms of this Agreement or by any applicable law or regulation.

Views

Some online banking services may not be available for certain accounts, customers, or through Mobile Banking. In addition, you agree that we may authorize such financial institutions to charge and debit your accounts based solely on these communications. You agree that your transfer instructions constitute authorization for us to complete the transfer. You represent and warrant to us that you have enough money in the applicable Accounts to make any Bank to Bank Transfer you request that we make on your behalf through the Service. You authorize us to select any means we deem suitable to provide your Bank to Bank Transfer instructions to the applicable financial institution.

All this is backed by our$0 Liability, Online Guaranteeagainst unauthorized access. With eStatements, you can view, download or print an electronic version of your statement. With Personal Internet Banking, it's easier than ever to manage your accounts online.

Lo querés, lo tenés. Pedí tu Préstamo Personal

You are responsible for any EFT transaction you make with your log on credentials. You are also responsible for any EFT transaction made by someone else to whom you have given your log on credentials until you notify us that the person no longer has your permission to use them. The Wire Transfer service is governed by the Funds Transfer provisions of the Rules for Consumer Deposit Accounts governing such account.

You agree not to effect any Bank to Bank Transfers from or to an Account that are not allowed under the rules or regulations applicable to such accounts including, without limitation, rules or regulations designed to prevent the transfer of funds in violation of OFAC regulations. If online banking services weren’t working properly, and you knew about the malfunction when you started the transaction or transfer. HSBC is under no obligation to inform you if it does not complete a transfer or payment because your available balance does not have enough funds to process the transfer or payment.

Important links

You may update your records, such as your email address, by using the “Communication preferences “section in Personal Internet Banking. Subject to HSBC’s Privacy Policy, you agree that HSBC may use, copy, modify, display and distribute any information, data, materials or other content (“Content”) you provide to HSBC for the purpose of providing the Service, and you hereby give HSBC a license to do so. By submitting Content, you represent that you have the right to license such Content to HSBC for the purposes set forth in this Agreement. In case of errors or questions about your electronic transactions, please refer to the HSBC Electronic Banking Services Information Statement.

You may not make Bank to Bank Transfers in excess of limits described on the Service. We reserve the right to change from time to time the dollar amount of the Bank to Bank Transfers you are permitted to make using our Service. Without limiting the foregoing, in the event that your use of the Service has been suspended and reinstated as provided herein (see “Suspension and Reinstatement of Bank to Bank Transfers” below), you understand and agree that your use of the Service thereafter may be subject to lower dollar amount limitations than would otherwise be permitted by us. Any customer service communications, including without limitation communications with respect to claims of error or unauthorized use of the Service. Once the test transfer is complete, we may ask you to access your Account to tell us the amount of the test credit or debit or any additional information reported by your bank with this test transfer. We may also verify Accounts by requiring the entry of information you ordinarily use to access the Account provider’s website, or by requiring you to submit proof of ownership of the Account.

About this app

You understand that financial institutions receiving the Bank to Bank Transfer instructions may rely on such information. We are not obliged to take any further steps to confirm or authenticate such instructions and will act on them without getting further confirmation. You understand that if you provide us with incorrect information or if there is any error in your instruction we will make all reasonable efforts to reverse or delete such instructions, but you accept full responsibility for losses resulting from any of your errors, duplication, ambiguities or fraud in the information that you provide. You agree not to impersonate any person or use a name that you are not authorized to use. If any information you provide is untrue, inaccurate, not current or incomplete, without limiting other remedies, HSBC reserves the right to recover from you any costs or losses incurred as a direct or indirect result of the inaccurate or incomplete information. Additionally, all Bank to Bank Transfers are also subject to the rules and regulations governing the relevant Accounts.

Safety starts with understanding how developers collect and share your data. Data privacy and security practices may vary based on your use, region, and age. HSBC Argentina is one of the largest financial organizations in Argentina and comprises HSBC Bank Argentina, HSBC MAXIMA AFJP, HSBC La Buenos Aires and HSBC New York Life. Proa is a local consumer finance company set up to draw on the experience and knowledge of HSBC Finance Corporation. The group's product and service distribution network includes 139 retail bank branches nationwide, as well as financial and pension fund offices. HSBC Argentina maintains deposits of around US$3 billion, and a lending portfolio of nearly US$2 billion (both around 4% of the domestic market).

All Communications in either electronic or paper format will be considered to be “in writing.” You should print a paper copy of this Agreement and any electronic Communication that is important to you and retain the copy for your records. If you do not agree to receive this Agreement or the Communications electronically, you may not use the Service. If you have not given us complete, correct and current instructions so that we can make a transfer or bill payment. If circumstances beyond our control prevented the transaction or transfer, despite reasonable precautions we’ve taken. You do not take steps to safeguard your account, personal firewalls and online security diligence outlined in the HSBC Security & Fraud Center.

These choices include banking channels, electronic networks, and funds transfer systems. You agree to be bound by the rules and regulations that govern the applicable funds transfer systems, such as automated clearinghouse as published by the National Automated Clearinghouse Association . We shall make all reasonable efforts to ensure that your transfer requests are processed on time; however, we reserve the right to hold funds beyond the normal period and if any interest is earned will be the property of HSBC. Personal Internet Banking will remain in effect until it is terminated by you or HSBC. You may cancel Personal Internet Banking at any time by notifying us of your intent to cancel in writing, through online banking secure Messages, or by other written correspondence. This cancellation applies to your Personal Internet Banking profile only, and does not terminate or close your HSBC accounts.

You shall at all times indemnify, defend and hold HSBC harmless from and against all actions, proceedings, claims or loss, damage, costs and expenses which may be brought against HSBC or incurred by HSBC and which shall have arisen in connection with the instructions transmitted by online banking relating to your business accounts. HSBCnet provides built-in security features permitting you to establish transfer and account access limitations that are not available on Personal Internet Banking. You authorize HSBC to withdraw, debit or charge the necessary funds from your designated account in order to complete all of your designated transfers and payments. You agree that you will instruct us to make a transfer or payment only when there is enough money in your account to cover the transaction at the time of the transfer or payment.

Bank to Bank Transfers can only be completed between accounts that are owned by the same account holder. In order to use Bank to Bank Transfers, you have to be a Personal Internet Banking customer of HSBC. Details of applicable limits can be found on the Bank to Bank Transfers section of the HSBC website. You may use this service to transfer funds to or from an HSBC account and another personal account in your name at another U.S. financial institution or an approved service provider investment account, through the Internet. Transactions may be scheduled to occur one time, for a future date, or recurring. Not all types of accounts are eligible for the Bank to Bank Transfers service.

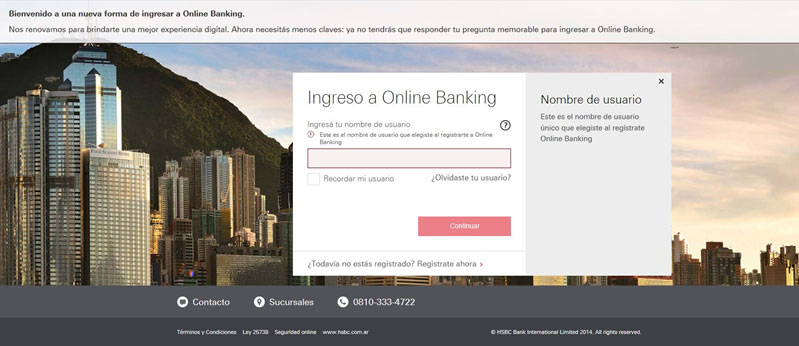

In order to view, print or save copies of your account statements and documents, you will need to ensure that the computer or device you are using meets the hardware and software requirements specified by the Electronic Communications Disclosure. To access all of the features and services offered by Personal Internet Banking, sign in directly through our website at from a personal computer. Please refer to this Agreement, related agreements for online services and your applicable account agreements and/or fee schedules for information on fees for online services. Certain types of transactions within Personal Internet Banking may require additional authentication using an HSBC Security Device.

No comments:

Post a Comment